Financial transparency

Children of the Mekong’s headquarters is in France. We have several chapters in the world such as our UK office where Children of the Mekong is registered at the Charity Commission for England and Wales (No 1116375) and is based in London.

We also have teams of dedicated volunteers in the Netherlands, Hong Kong, Singapore, Belgium, Luxembourg, Germany, Switzerland and the USA.

The work of Children of the Mekong is made possible only by the generous support of thousands of sponsors, donors, partners and volunteers. Your commitment makes us even more determined to be as effective and as transparent as possible in all that we do.

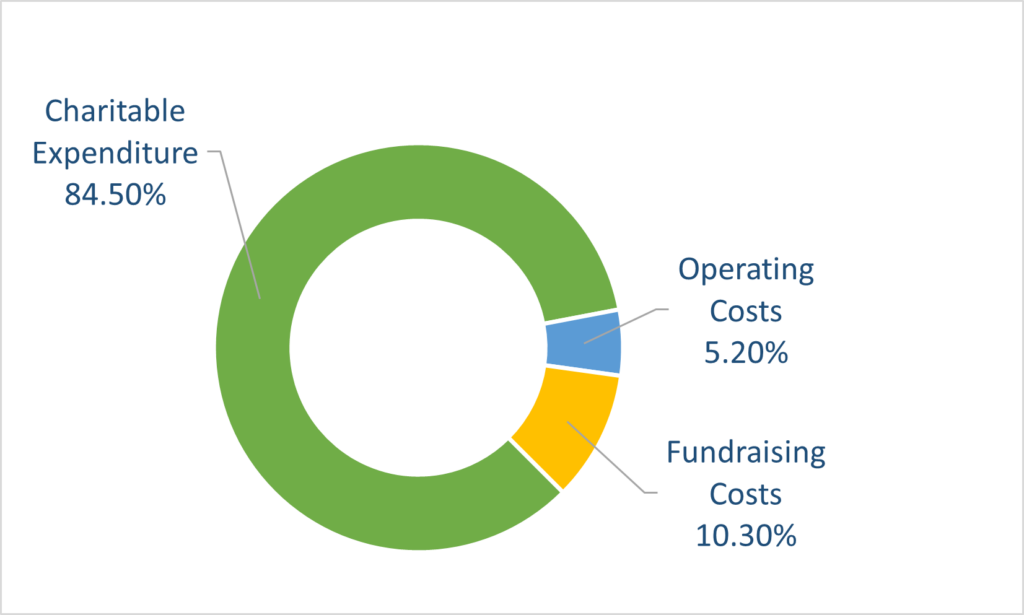

HOW WE SPEND MONEY

Charitable Expenditure

Year 2022

84.5 % charitable expenditure rate to support underprivileged children in Southeast Asia.

The rest is used for fundraising and admin costs to run the charity.

Our income comes exclusively from private donors.

Download Children of the Mekong International’s Latest Annual Report

CHILDREN OF THE MEKONG, IN A NUTSHELL

65 years of existence

70,000 children supported

23,535 sponsored children

1,044 sponsorship programmes

153 development programmes supported in 2022

1,200 volunteers

112 local employees in Asia

49 overseas volunteers (called “Bamboo”)

70 chapters of volunteers in France and overseas

84.5% charitable expenditure

10.3% fundraising costs

5.2% operating costs

WHAT IS GIFT AID? A GREAT WAY TO INCREASE YOUR IMPACT IF YOU ARE UK TAX PAYER

Gift Aid is a tax relief scheme that benefits charities that receive donations from UK taxpayers in the United Kingdom.

- Gift Aid allows us to reclaim the tax you have paid on all qualifying donations to Children of the Mekong’s work. This increases the value of your donations by 25% at no extra cost.

- You must pay an amount of UK Income Tax and/or Capital Gains tax at least equal to the tax Children of the Mekong will reclaim on your donations during each tax year.

- Completing a Gift Aid declaration does not affect your tax status or commit you to support Children of the Mekong’s work for a specified length of time.

- If you pay tax at the higher rate you can claim further tax relief in your Self Assessment tax return.

Learn more about our privacy policy here.